Mergers and acquisitions (M&A) can be transformative steps for businesses looking to expand, enter new markets, or achieve synergies. However, these complex transactions often involve numerous challenges. Even the most promising deals can be derailed by avoidable mistakes. Here, we explore the five most common pitfalls in M&A deals and offer actionable strategies to navigate them successfully.

1. Inadequate Due Diligence

One of the most critical stages in any M&A transaction is due diligence. Failing to conduct comprehensive due diligence can result in acquiring unforeseen liabilities, inheriting unresolved legal disputes, or overlooking key operational inefficiencies.

Key Issues to Address:

- Financial Review: Ensure all financial statements are accurate and free from anomalies.

- Legal Compliance: Verify that the target company adheres to all applicable regulations and has no outstanding legal disputes.

- Operational Health: Understand the company’s workflows, supply chain dependencies, and market position.

Best Practices:

- Partner with experienced M&A advisors and legal professionals.

- Use a checklist to cover all due diligence aspects, including financial, legal, operational, and environmental.

- Employ technology solutions like virtual data rooms to centralize and streamline the due diligence process.

2. Overpaying for the Target Business

Valuation is both an art and a science. Overpaying for an acquisition can place significant financial strain on the buyer, reducing the potential return on investment.

Common Causes of Overpayment:

- Emotional decision-making or competition during a bidding war.

- Relying on overly optimistic projections rather than grounded market analysis.

- Ignoring hidden costs such as debt obligations, restructuring expenses, or compliance upgrades.

How to Prevent Overpayment:

- Conduct a rigorous valuation using multiple methods, such as discounted cash flow (DCF) analysis, market comparables, and precedent transactions.

- Engage independent valuation experts for an objective assessment.

- Maintain discipline and establish a maximum bid limit based on thorough financial modeling.

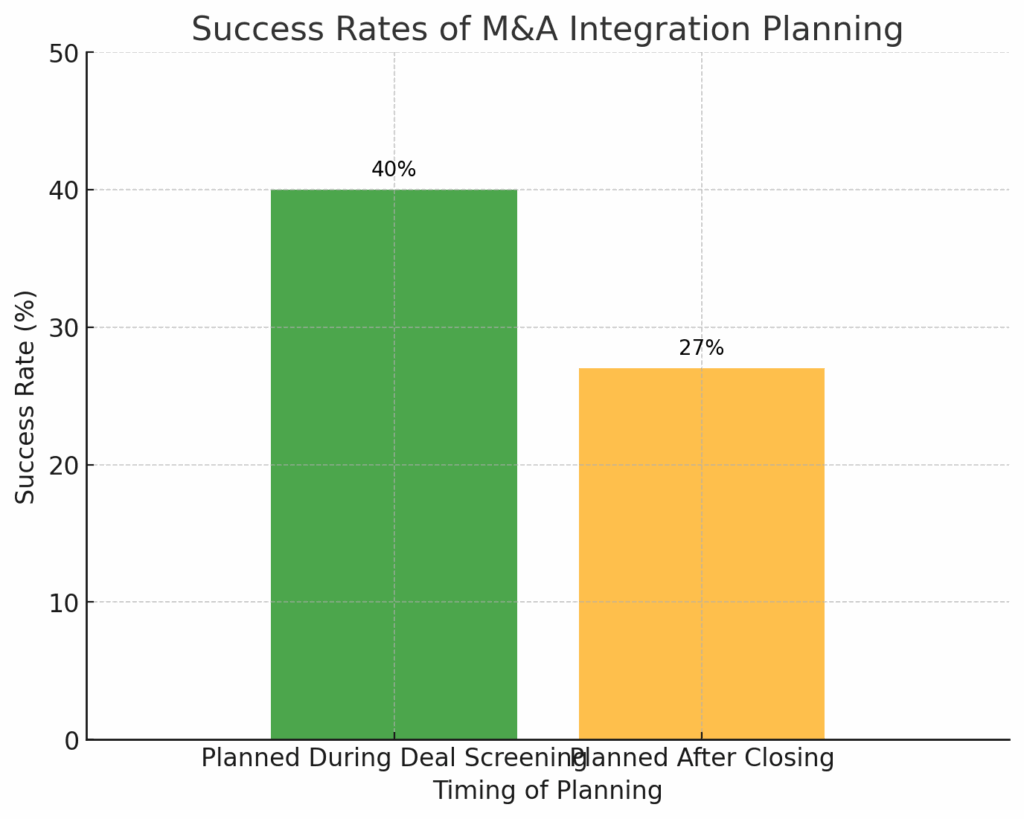

3. Poor Integration Planning

M&A success doesn’t stop at deal closure. In fact, post-merger integration (PMI) is where the real work begins. Without a well-thought-out integration plan, businesses risk operational inefficiencies, loss of key talent, and cultural clashes.

Common Challenges:

- Aligning different corporate cultures and management styles.

- Integrating IT systems, supply chains, and workflows.

- Retaining employees and minimizing turnover during the transition period.

Solutions:

- Develop a detailed PMI roadmap before closing the deal, covering short-term and long-term priorities.

- Appoint an integration manager to oversee the process.

- Foster open communication and transparency with employees to build trust and reduce uncertainty.

Data shows that early integration planning during deal screening results in a 40% success rate, compared to 27% when planned after closing.

4. Ignoring Employment Law Issues

Employment law considerations are critical in any M&A transaction, particularly when transferring employees from one entity to another. In the UK, for example, Transfer of Undertakings (Protection of Employment) Regulations (TUPE) apply, ensuring employees’ rights are protected during business transfers.

Risks of Non-Compliance:

- Legal disputes and penalties.

- Employee dissatisfaction and potential attrition.

- Reputational damage.

How to Address Employment Law Issues:

- Work with legal counsel familiar with local labor laws to ensure compliance.

- Communicate openly with employees about how the deal affects them.

- Conduct a thorough review of employment contracts, benefits, and union agreements.

5. Unrealistic Expectations

While M&A deals can bring significant benefits, setting unrealistic goals can lead to disappointment and strained relationships between stakeholders.

Examples of Unrealistic Expectations:

- Overestimating cost synergies or revenue growth.

- Expecting a seamless integration without accounting for potential challenges.

- Assuming immediate financial returns.

Strategies for Managing Expectations:

- Set clear, measurable objectives based on realistic assumptions.

- Regularly review progress and adjust plans as needed.

- Maintain open lines of communication with stakeholders to align on goals and milestones.

Conclusion

M&A deals hold immense potential but require meticulous planning and execution to succeed. By avoiding these common pitfalls—inadequate due diligence, overpayment, poor integration planning, ignoring employment laws, and setting unrealistic expectations—businesses can maximise the value of their transactions.

Partnering with experienced legal and financial experts is essential for navigating the complexities of M&A. Are you ready to take the next step in your M&A journey? Contact us today for tailored guidance and support.

Let our team of experienced M&A lawyers guide you through every stage of the process, providing the insights and expertise needed to succeed in the dynamic UK market.

- Luton: +44 1582 383 888

- London: +44 2034 393 888

- St Albans: +44 1727 519 888

Alternatively, complete our contact form, and one of us will get in touch promptly to discuss your needs.